See our services.

Individual taxes

Business taxes

Tax compliances

Bookkeeping

Financial planning

Tech consuting

For students

Foreign citizens

01

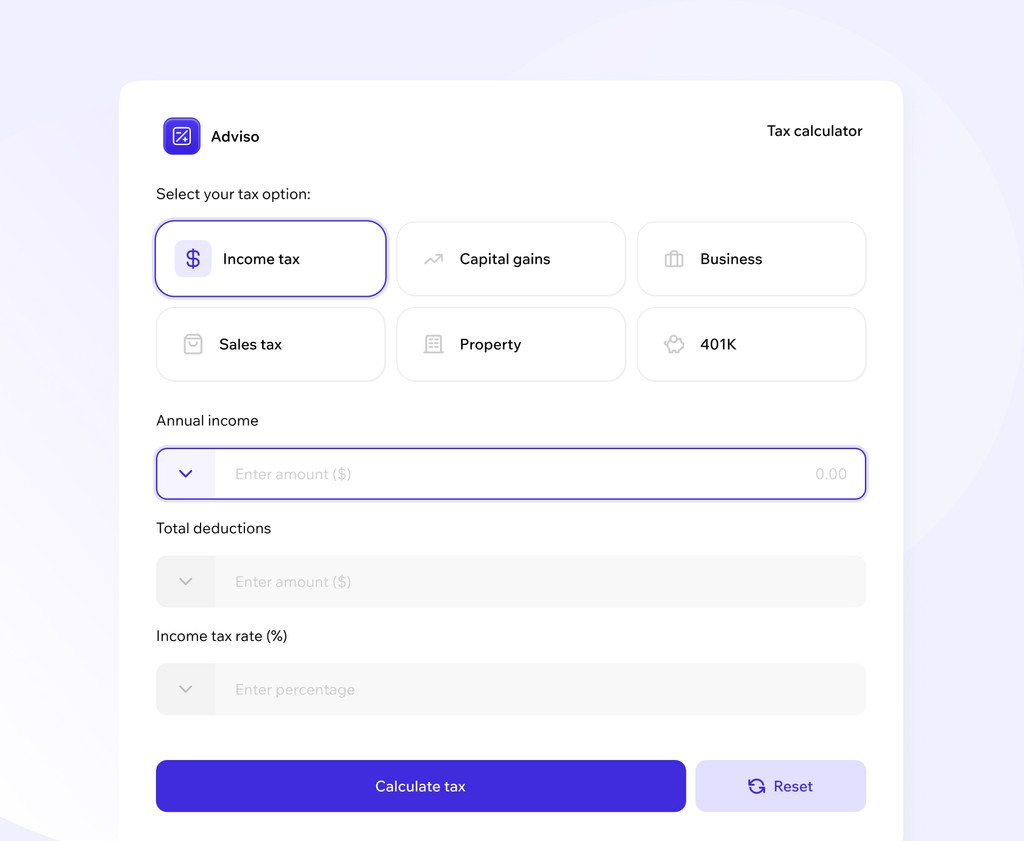

Individual taxes

We help you plan so you can save and keep more money in your business.

Maximize your deductions

Plan for future tax liabilities

Optimize tax-saving strategies

Reduce surprise tax bills

Year-round support and advice

Tailored plans to fit your business

02

Business taxes

Let us handle the complex tax filings for your corporation so you can stay compliant without the headache.

Ensure accurate and timely filings

Minimize your tax burden

Understand applicable credits and deductions

Manage multi-state filings

Reduce risk of audits

Support through IRS or state inquiries

03

Tax compliances

Stay compliant with all tax laws and regulations so you never have to worry about penalties or fines.

Keep up with changing tax laws

File on time, every time

Avoid costly penalties

Stay organized with documents

Get audit-ready financials

Ongoing compliance checks

04

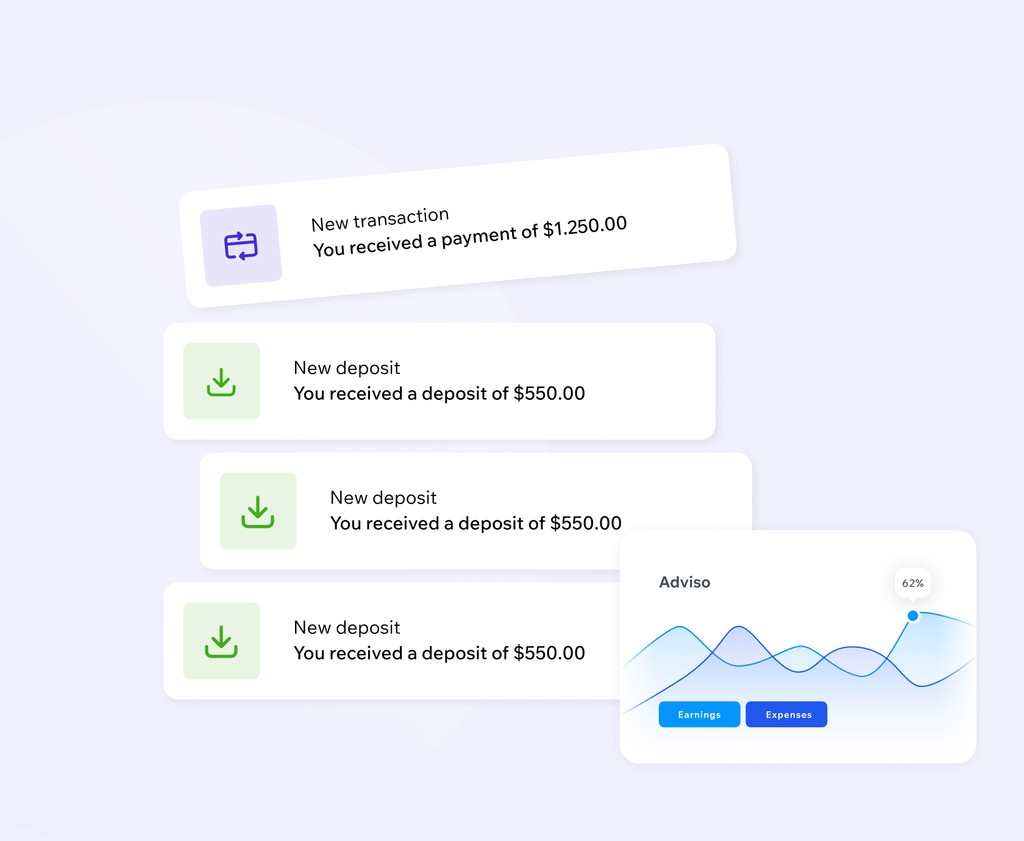

Bookkeeping

Stay on top of your finances with our accurate and stress-free bookkeeping services.

Track income and expenses easily

Keep financial records organized

Get clean reports anytime

Prepare for tax season with ease

Reconcile your accounts monthly

Stay compliant with financial regulations

05

Financial planning

We’ll help you create a solid business plan that drives growth and attracts investors.

Develop a custom business strategy

Set realistic financial goals

Create a clear roadmap for success

Attract investors with a strong plan

Identify market opportunities

Forecast revenue and expenses

06

Tech consulting

Need help integrating the right tech tools for your business? We’ve got you covered.

Find the best tech solutions

Streamline your operations

Automate tedious tasks

Improve your team’s productivity

Ensure seamless integration

Get ongoing tech support

07

For students

We offer tax and financial advice tailored specifically for students, helping you stay ahead while focusing on your studies.

Understand your tax obligations

Maximize education-related deductions

File your taxes easily

Plan for student loan repayments

Get budgeting and saving tips

Avoid common student tax mistakes

08

Foreign Citizens

We help foreign citizens navigate the U.S. tax system with ease, ensuring you stay compliant and maximize your savings.

Navigate international tax laws

Maximize foreign-earned income exclusions

Understand dual citizenship tax obligations

File U.S. taxes from abroad

Avoid double taxation

Support with visas and tax residency issues