Big corporations

Simplify Corporate Tax Challenges.

We help large corporations navigate complex tax laws and reduce costs through expert planning and compliance strategies.

Big corporations

How we help:

Running a large corporation comes with unique financial and tax challenges. At Adviso, we provide tailored solutions that minimize tax liabilities and ensure compliance with both domestic and international regulations.

Our goal is to help you optimize your tax strategy so you can focus on growing your business.

Handle complex corporate tax filings with precision.

Reduce your tax burden through strategic planning.

Ensure full compliance with regulations, both domestic and international.

Help you structure your business for optimal tax efficiency.

Provide ongoing advice to keep your company financially strong.

01

Strategic Planning

Reduce your tax liabilities and increase savings with our expert strategies.

02

Compliance Management

Ensure full compliance with domestic and international regulations, stress-free.

03

Growth Focused

We help structure your business for optimal tax efficiency as you scale.

Small businesses

Keep Your Small Business Financially Strong.

We make taxes simple, saving you time and money, so you can focus on growing your small business.

Small businesses

How we help:

Small businesses face enough challenges—taxes and financial stress shouldn’t be one of them.

Adviso works with small business owners to streamline tax filings, manage cash flow, and provide financial planning advice that will keep your business growing year after year.

Minimize your tax bill through expert advice.

Take the stress out of quarterly tax filings.

Maximize deductions for equipment, office expenses, and more.

Help manage cash flow and financial planning for growth.

Provide clear financial reports to keep your business on track.

01

Affordable Solutions

We help you minimize your tax burden, keeping more cash in your business.

02

Easy Filing

Our experts ensure you meet all your tax deadlines and compliance requirements.

03

Growth Focused

Financial planning that helps you stay on track as your business expands.

Startups

Build Your Startup with Confidence.

We make sure you stay tax-compliant and financially efficient, so you can focus on growing your startup.

Startups

How we help:

At Adviso, we partner with startups to ensure tax compliance, manage cash flow, and provide strategic financial advice.

Whether you're in the early stages or expanding rapidly, we help you navigate the complexities of tax planning.

Advise on the best tax structure for your startup.

Guide you through R&D credits and other tax-saving opportunities.

Ensure compliance with tax filings and deadlines.

Help you plan for sustainable growth.

Offer financial planning that supports expansion.

01

Tax-Smart Structure

Get expert advice on the best tax setup for your startup’s long-term success.

02

Growth Planning

Financial guidance that helps you expand sustainably while minimizing tax risks.

03

Cost-Efficient

Unlock tax credits and savings opportunities designed specifically for startups.

Non-profits

Keep Your Non-Profit Focused on Its Mission.

We handle the financial and tax complexities so you can focus on making a difference, not managing paperwork.

Non-profits

How we help:

Running a non-profit comes with its own set of tax and financial challenges.

Our team ensures your organization remains tax-compliant, maximizes funding opportunities, and efficiently manages its finances to support your mission.

Ensure compliance and keep your tax-exempt status secure.

Make the most of grants and donations with expert financial guidance.

Get more value from your donors through smarter planning.

Stay on top of federal and state regulations effortlessly.

Provide clear, accurate financials for donors and stakeholders.

01

Tax-Exempt Expertise

We make sure your tax-exempt status is protected, helping you stay compliant with ease.

02

Optimized Funding

Get the most from your grants and donations by applying smart financial strategies.

03

Regulatory Peace of Mind

We handle compliance, so you don’t have to worry about changing tax laws or reporting requirements.

LLCs

Make Your LLC Work for You.

We help LLC owners navigate taxes, deductions, and compliance with ease to maximize flexibility and success.

LLCs

How we help:

Limited Liability Companies (LLCs) face specific tax requirements, but they also offer incredible flexibility.

Our team at Adviso makes sure you’re taking full advantage of every tax benefit while keeping your business in full compliance with federal, state, and local laws.

Simplify LLC tax filings and deadlines.

Advise on tax-efficient ways to distribute profits.

Maximize deductions specific to your industry and business.

Keep you compliant with federal, state, and local tax laws.

Provide ongoing support as your business grows.

01

Flexible Strategies

Leverage your LLC’s flexibility with tax-efficient ways to manage profits.

02

Compliance Support

Stay fully compliant with federal, state, and local tax laws, year-round.

03

Maximized Deductions

Discover every deduction available to your business and industry.

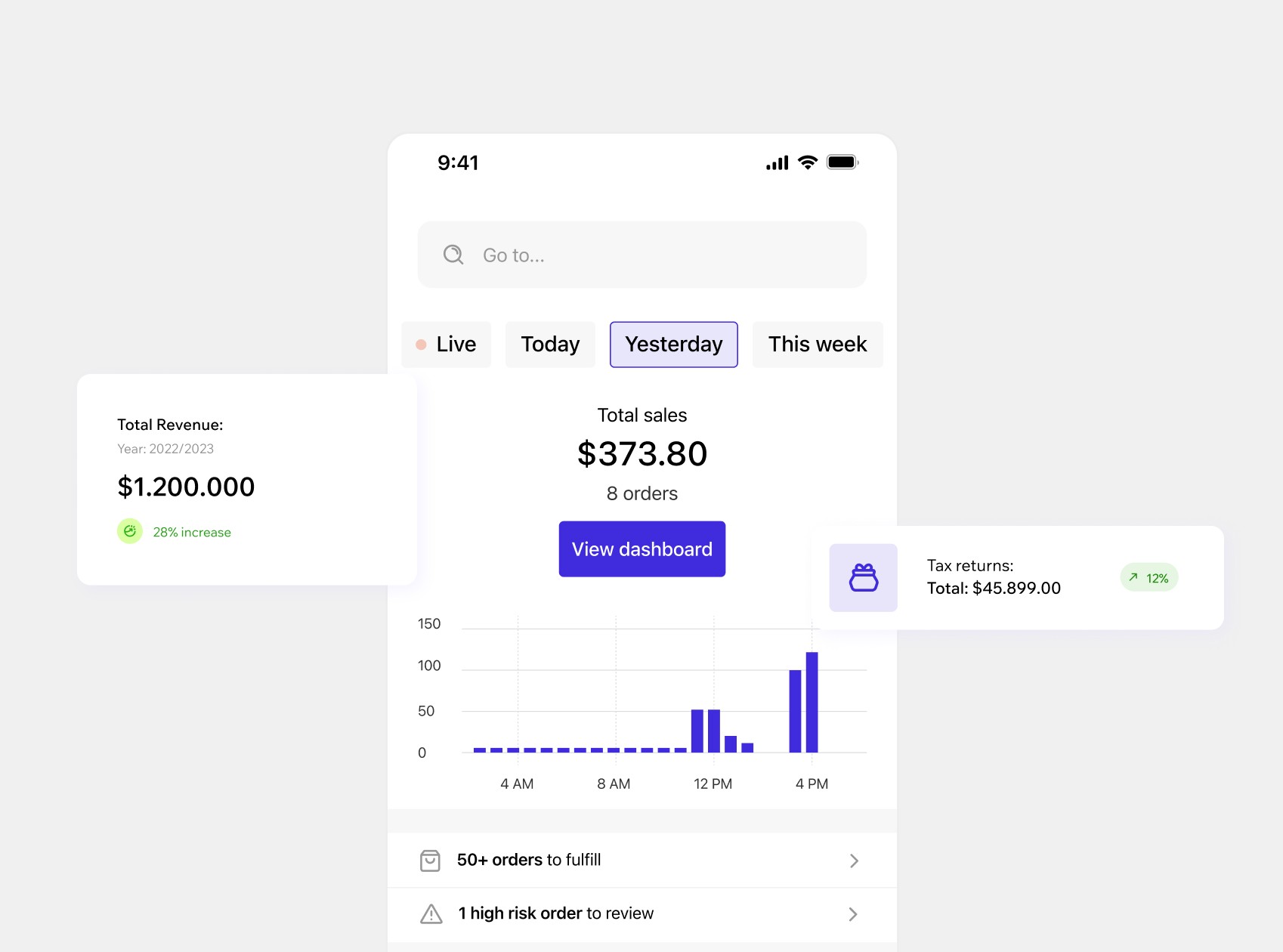

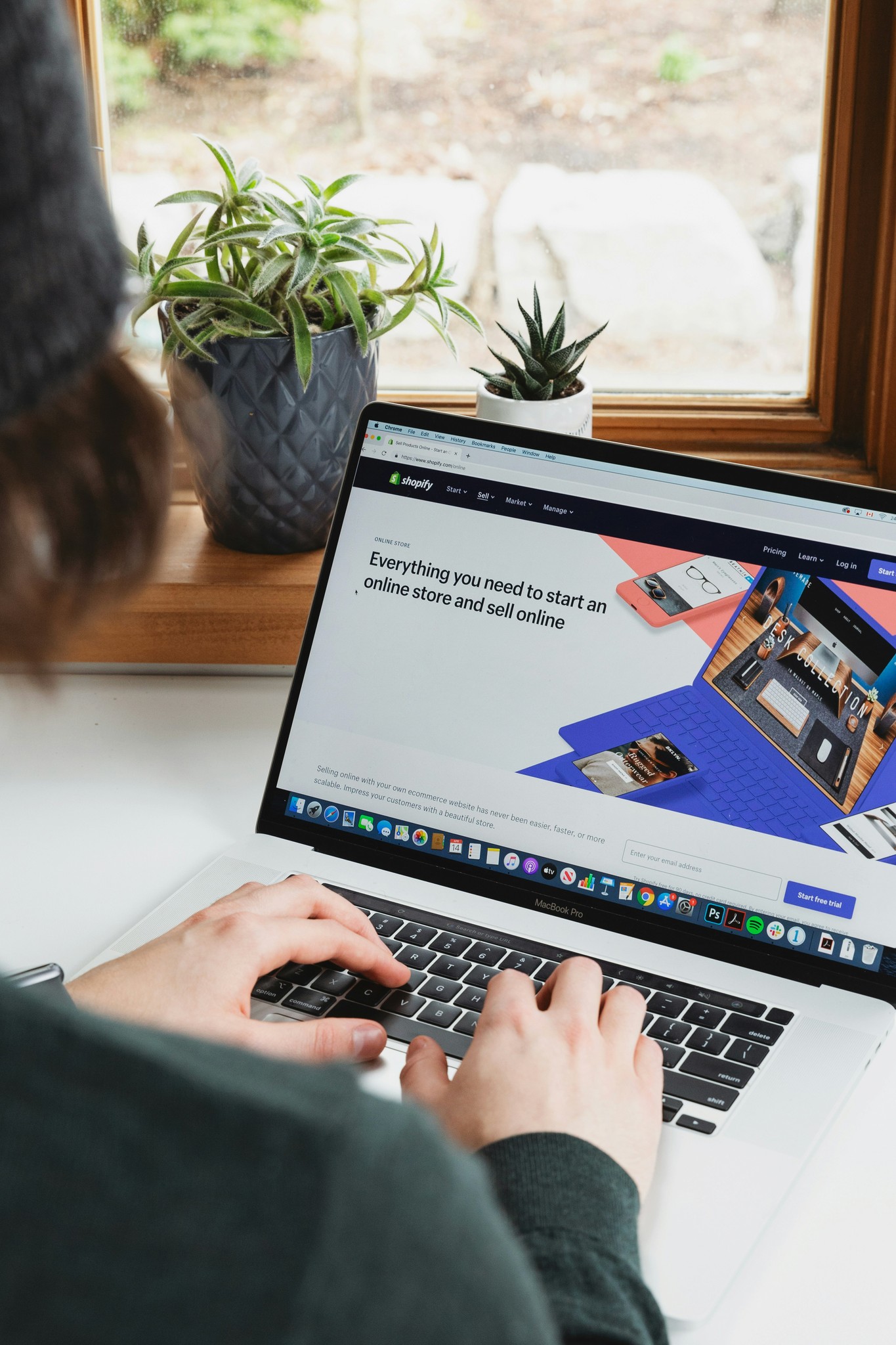

e-Commerce

Master E-Commerce Taxes with Confidence.

From sales tax to digital products, we handle the complexities of e-commerce taxes so you can focus on growing your business.

e-Commerce

How we help:

Operating an e-commerce business means navigating multiple tax laws and regulations across different regions.

Adviso specializes in helping online businesses stay compliant, maximize deductions, and keep your finances in check, so you can focus on expanding your online store.

Simplify sales tax compliance across multiple states and countries.

Maximize deductions for inventory, shipping, and business expenses.

Guide you through digital product tax rules.

Ensure tax compliance with changing e-commerce regulations.

Help scale your business with long-term financial planning.

01

Sales Tax Simplified

We handle compliance across multiple states and countries for you.

02

Deduction Optimization

Maximize your savings for inventory, shipping, and digital product taxes.

03

Long-Term Planning

Financial strategies that help your e-commerce business scale efficiently.

Fintech

Stay Compliant in the Fast-Paced World of Fintech.

We help fintech companies navigate tax regulations, manage digital assets, and stay compliant with evolving industry standards.

Fintech

How we help:

The fintech industry moves fast, as do the tax laws that affect it. At Adviso, we specialize in helping fintech companies manage tax compliance, digital asset taxation, and R&D credits.

We keep you on track with your financial goals while complying with regulations in an ever-changing landscape.

Provide tax guidance for digital assets and cryptocurrency.

Help navigate international tax laws and cross-border compliance.

Optimize R&D tax credits for fintech innovation.

Ensure compliance with regulations as the industry evolves.

Offer financial planning to scale your business sustainably.

01

Digital Asset Expertise

Guidance on taxation for cryptocurrency and other digital assets.

02

R&D Credits

Maximize tax credits for your fintech innovations and product development.

03

Compliance Assurance

We keep your company aligned with ever-changing fintech regulations.

Real state

Optimize Your Real Estate Investments.

Our real estate tax experts help you navigate complex tax laws, ensuring you maximize returns on every property.

Real estate

How we help:

Real estate investments offer unique tax opportunities but also have complex rules and regulations.

Whether you're buying, selling, or managing properties, Adviso’s expert team will guide you through maximizing deductions and planning for long-term financial success.

Maximize deductions for property depreciation, repairs, and upgrades.

Navigate capital gains and losses on property sales.

Guide you through 1031 exchanges and tax deferrals.

Provide ongoing tax planning to grow your real estate portfolio.

Ensure compliance with local, state, and federal tax laws.

01

Maximized Deductions

Take advantage of every tax benefit, from depreciation to capital gains.

02

Tax-Efficient Sales

We guide you through property sales with smart strategies like 1031 exchanges.

03

Portfolio Growth

Ongoing tax planning to help you build and expand your real estate investments.